Where you put your money; matters.

Bangalore, India, 2nd October 2023, ZEX PR WIRE, You want to do good for the planet, but you don’t know how. You may be guilt tripped into donating to a cause for which there is low accountability, and if you genuinely want to make a difference, your options are limited. What if you could invest in GreenTech, do good for the planet, and do well personally as well. That’s the vision for Yield.

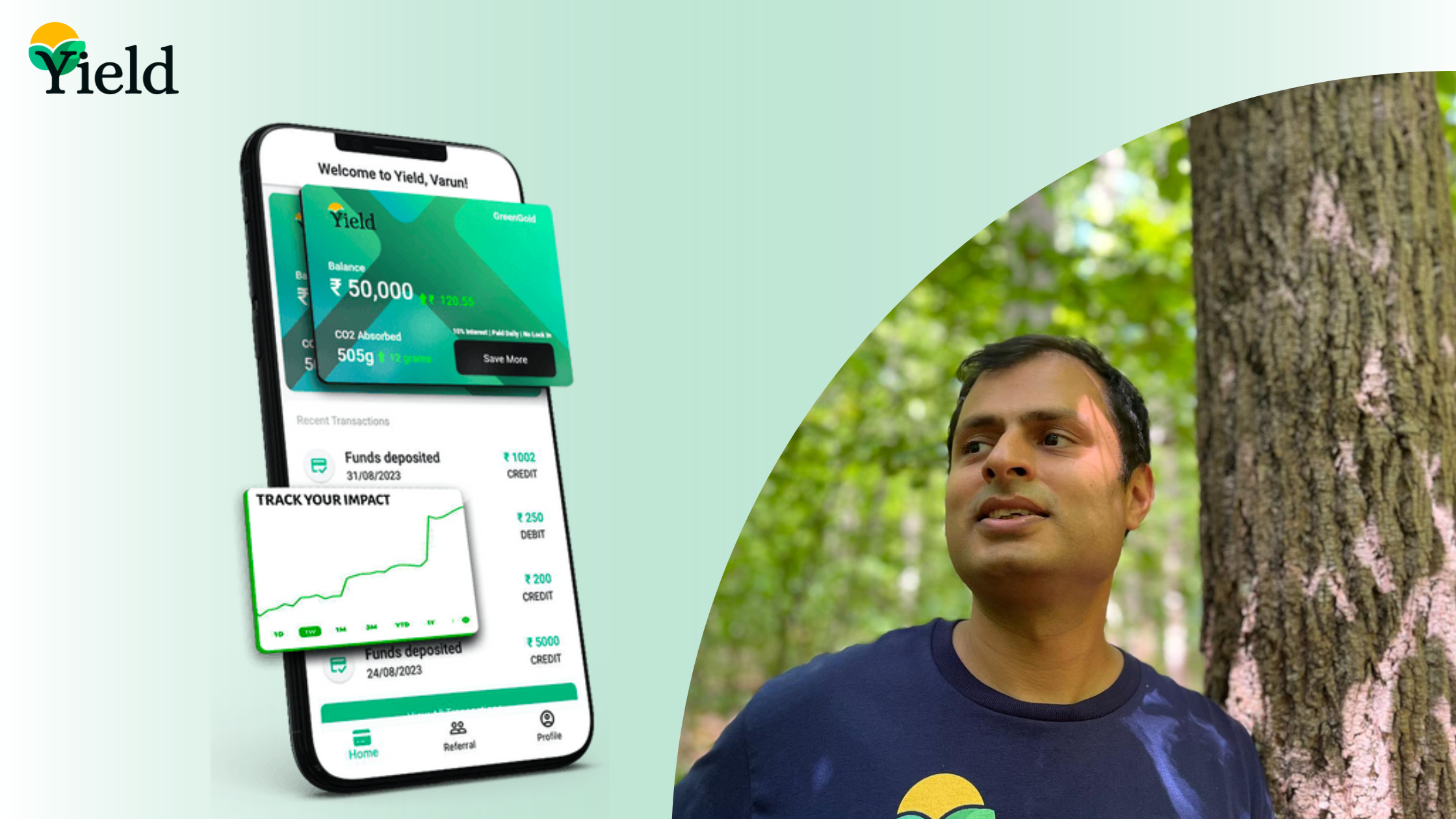

Founded by Varun, Yield’s goal is to help direct capital to where it needs to be. There are tens of thousands of companies, and people that want to invest in green, but the upfront cost is prohibitive. Yield’s vision is to help these businesses grow by directing capital to them. As an example, it could be as simple as providing them a loan specifically for green projects, to turn that CapEx into an OpEx.

With his experience of two successful startups behind him (Quick Commerce Exit To Getir, WhatsApp SaaS To GoKwik) Yield seems poised to make a realdifference.

Varun, the founder of Yield, expressed his excitement about the launch, but noted the platform’s shortcomings: “What Robinhood and Zerodha are for retail investors; we want to be for impact investors. We want everyone to be able to make an impact and at the same time get fantastic returns on their capital.”

“Many traditional banks provide minimal interest rates on savings, often ranging from 3% to 6% per annum. Yield’s goal is to empower users to earn upwards of 10% interest per annum, while making a positive impact on the planet. It needs to be a better financial product, just like how Tesla is in fact, a better car. Not only is it better for the planet, it also just inherently works better and that’s what Yield wants to be for financial instruments.”

At the core of Yield’s mission is to allow you to invest your principal, with principles. The platform gives you the option to invest in projects such as solar installations and electric vehicles. The underlying asset classes are different for each, but each is and will be completely RBI approved and SEBI regulated; as applicable.

It’s a small step, and it’s far from perfect right now. We want to invest in projects that have higher environmental standards, and make more of an impact as soon as we can. That being said, even when we’re not able to ascertain a base level impact, we help additionally offset carbon by directly planting trees for our assets under management.

Yield’s dedication to financial innovation and environmental sustainability sets it apart in the financial industry. The platform’s transparent approach and commitment to creating a positive environmental impact make it an attractive choice for individuals looking to grow their wealth while contributing to a greener world.

To learn more about Yield and start investing in a brighter future, visit [https://www.yld.earth/].

Please note that Yield is currently available exclusively in India and can be downloaded on iOS and Android.

Disclaimer: The information provided in this press release is for informational purposes only and does not constitute financial advice. Investments involve risk, and past performance is not indicative of future results. Please conduct your own research and consult with a financial advisor before making any investment decisions.

The Post Yield: Democratizing Impact Investing first appeared on ZEX PR Wire

Information contained on this page is provided by an independent third-party content provider. Binary News Network and this Site make no warranties or representations in connection therewith. If you are affiliated with this page and would like it removed please contact [email protected]